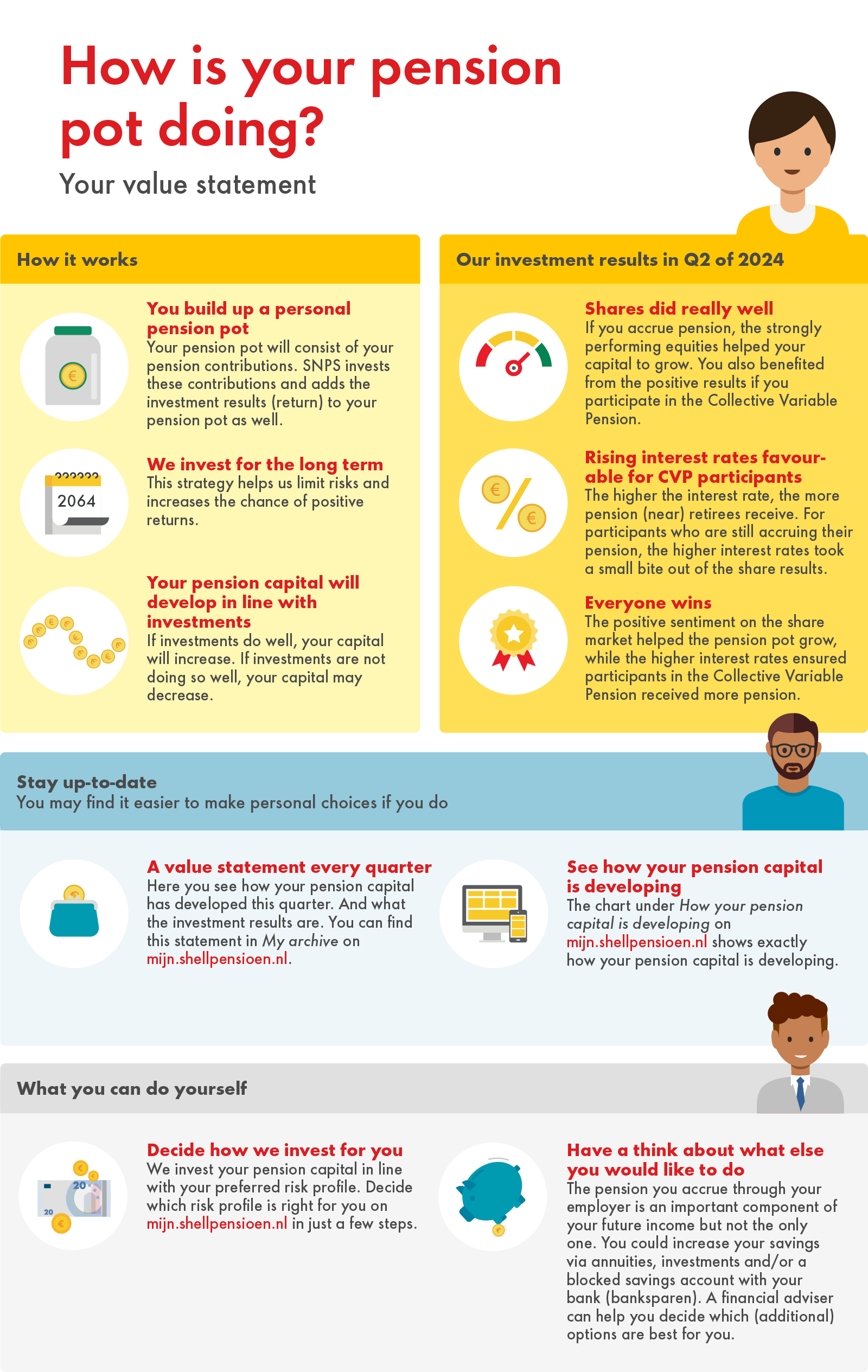

“Everyone has benefited in the last quarter”

At SNPS, you accrue a personal pension pot using your pension contributions. SNPS invests this pension pot to ensure that you will have a good pension in the future based on the investment results (yield).That doesn’t come without risk. Investments can yield more, but it is also possible to lose money.

Want to know how your pension is doing after the second quarter of 2024? Find out by checking your value statement on my-Shell pension under My archive.

Also read the interview with Jeroen Roskam, fiduciary advisor at Achmea Investment Management (AIM). In the article under the infographic, he uses 3 key terms to update us on what's been happening. He also explains what the investment results and the economic developments mean for your pension pot.

Check how your pension pot is doing

1. LOWER INTEREST RATE: European Central Bank cut interest rates in June

“The goal of the European Central Bank (ECB) is to keep inflation at 2% in the medium term. With inflation now nearing that target, the ECB no longer needs to keep interest rates high. That's why they reduced the interest rate by 0.25% in June. The short-term interest rate is currently at 4.25%. The market assumes that more rate cuts will follow. Whether that will actually happen remains to be seen. The ECB has hinted that, for the time being at least, inflation will remain slightly higher than initially calculated. This would mean that interest rates will drop at a somewhat slower rate than the market expects.”

2. FINANCIAL MARKETS: shares did really well

“Shares in developed markets as well as in emerging markets have performed really well during the past three months. The same was true for commodities. Share prices are mainly being driven up by the strong emergence of AI shares. The shares of companies in artificial intelligence are simply doing incredibly well. With NVIDIA leading the pack. The company is constantly breaking records, which also profits the stock markets. And therefore also our participants.”

3. POLITICS: French elections and the Taiwan-China relations influence sentiment

“Because President Macron called new parliamentary elections after his loss, the risk on French government bonds has risen somewhat. Investors are now looking to receive a higher interest for these government bonds. We therefore need to keep a close eye on developments in this EU nation. On top of that, there are ongoing concerns about relations between Taiwan and China. China is putting more pressure on Taiwan, while Taiwan in turn is seeking stronger international cooperation. Any further escalation of the conflict may have an impact on Europe and the Netherlands, considering the potential disruption to the global economy. After all, Taiwan plays a key role in the world economy. Especially its semiconductor industry.”

|

Your pension pot after the second quarter |