“Return on yield favourable for participants”

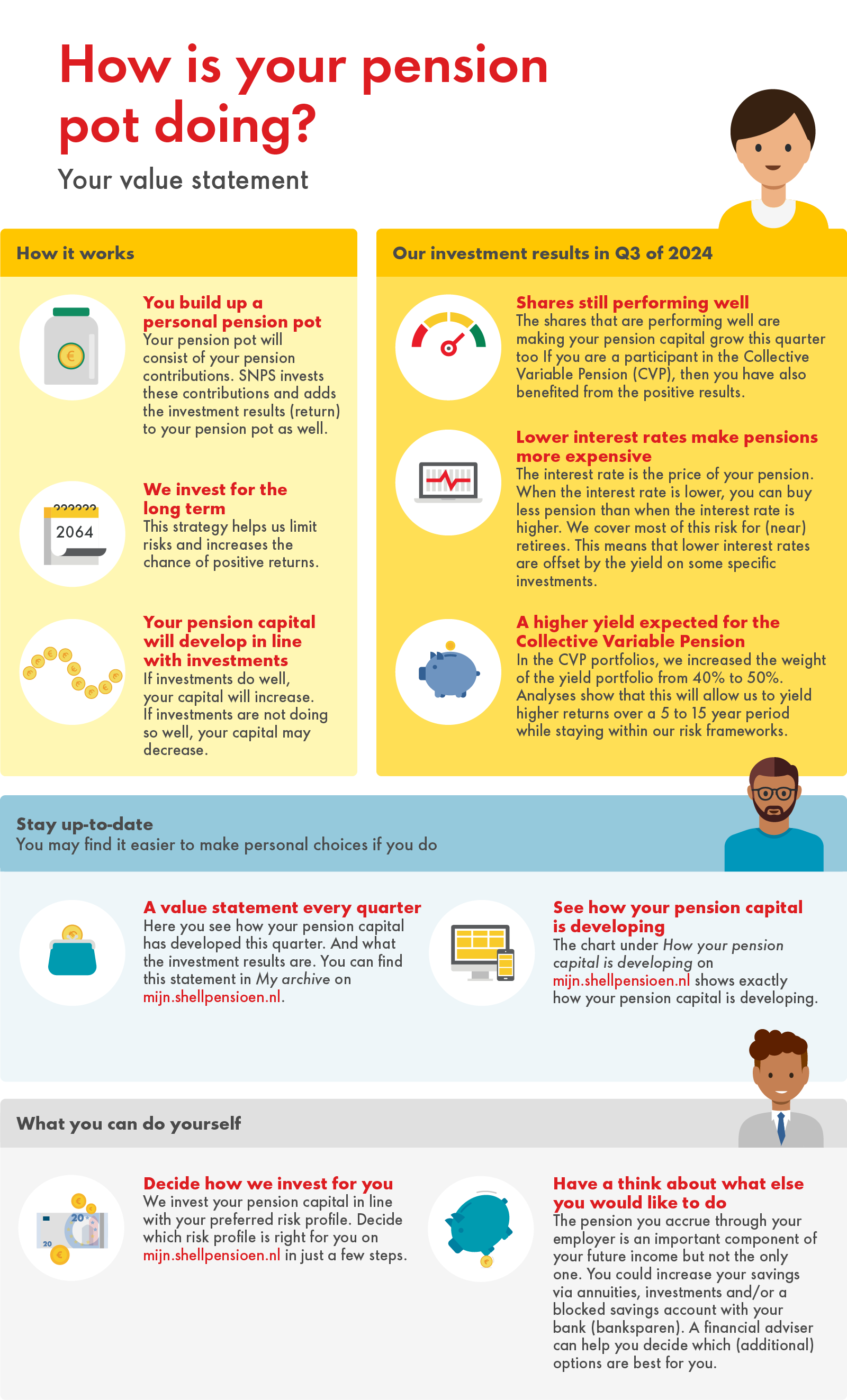

At SNPS, you accrue a personal pension pot using your pension contributions. SNPS invests this pension pot to ensure that, with the result of the investments (yield), you will have a good pension later on. This is not without risk. Investing can yield more, but you can also lose money. The amount of pension capital you have varies, and so does the value of your (expected) pension.

See how the investments for your pension have developed.

You will receive the quarterly value statement on my-Shell pension under ‘My Archive’. The latest statement is available for you.

Want to know how your pension is doing after the third quarter of 2024?

Then you can also read the interview below the infographic with Jeroen Roskam, fiduciary advisor at Achmea Investment Management.

Check how your pension pot is doing

Investing more interesting due to lower interest rates.

“In September this year, the European Central Bank (ECB) cut interest rates by 0.25% for the second time in 2024 from 3.75% to 3.5%. The US central bank – the Fed – also cut interest rates. Lower interest rates are possible as inflation remains under control in Europe and America. This also means lower interest rates on savings accounts and mortgages. This trend is expected to continue. This is good news for the economy as lower interest rates make it easier for companies to borrow and invest. Interest rate cuts also often boost the value of bonds and equities. Lower interest rates also make investing more attractive than saving. What remains important is that the economy continues to run well.”

Investors show little reaction to turmoil in the Middle East.

“The positive financial news is certainly in stark contrast to what is going on in the Middle East. A more protracted war is looming there. Remarkably, the financial markets have yet to truly react, if at all. Consequently, we are not yet seeing a negative impact on investment results or pension capital. We do consider the fact that the unrest in the Middle East has not been factored into share prices as a risk.”

China’s growth falters, but Chinese shares rise again.

“After years of prosperity, China has been losing momentum for some time now. Economic growth has weakened considerably and the property sector is under pressure. As a result, last summer China’s central bank introduced a package of measures to return the economy to at least 5% growth. Whether that will actually work remains to be seen, but we did notice that return on Chinese shares was very high in September. This means that investors are reacting enthusiastically to the support measures. This is also good news for investors on this side of the world since so many companies do business with China.”

We are taking slightly more risk within the Collective Variable Pension Portfolio.

“We have invested 40% in the yield portfolio in the CVP. In recent months, we researched the matter further and raised it to 50%. Analyses show that this will allow us to yield higher returns over a 5 to 15 year period while staying within our risk frameworks.”

Your pension pot after the third quarter.

What do the investment results and political and economic developments mean for your pension pot?

Shares that do well make your pension capital continue to grow.

“All three risk profiles (defensive, neutral and offensive) invest in the Life cycle portfolio Return. This portfolio invests mostly in shares. For the offensive profile, we invest the most in this portfolio during the period of pension accrual, which means that this risk profile generally generates the highest yield in good economic times. But also for neutral and defensive risk profiles, we consciously invest a large part of the capital in this return portfolio. Until September, the yield for this portfolio was around 13%. This means that all the risk profiles benefited from the positive results in Q3. In other words, participants have seen their capital grow over the past 3 months.”

Near retirees also benefited from strong share performance.

“Also in the Collective Variable Pension Portfolio we invest in the return portfolio. This means that those close to retirement also profit from the positive yields. The CVP portfolio result up to the third quarter is at about 6.5%.”