Investing with positive energy

As a long-term investor, we are an engaged and committed shareholder that not only strives for the best return for your Shell pension, but also require that the companies it invests in are responsible and good employers.

Companies in our investment portfolio showing irresponsible business practices will be addressed. We do this first and foremost through open dialogue and by ensuring our votes are heard at their shareholders' meetings.

Ultimately, our belief is that responsible investing leads to a secure pension.

We utilise several ESG-instruments to achieve our goals. When it comes to carbon intensity and good governance, we want our investments to outperform the market.

Our investment policy also devotes specific attention to gender equality, sustainable cities, and clean and affordable energy. Research shows that, on top of climate action, participants also consider these topics important. Always in conjunction with a good pension.

Investing with positive energy for a better world. Both for today and tomorrow.

Positive energy. In our view, that's responsible investing: good for you, good for the world. Investment choices are therefore not only financially driven but also focussed on ESG factors (ESG: Environmental, Social and Governance investing). That's because ESG factors influence the investment risk and yield of all asset classes.

As a pension fund, we are actively involved as shareholder. We ask companies in our investment portfolio, that could perform better on ESG, to join our engagement programme. This means that we initiate dialogues with these companies. Additionally, we exercise our right to vote to drive positive change.

It is our belief that strong corporate governance (G) enhances performance in environmental (E) and social (S) factors.

Our responsible investing has the following objectives:

• We want our responsible investment policy and its implementation to comply with treaties, laws, directives, codes and existing agreements in this area.

• We want to communicate our choices and results in a way that is transparent and clear for all our stakeholders.

• We are committed to achieving sustainable environmental, social and governance improvements, such as reducing the CO₂ intensity of our investments and focusing on companies with above-average governance performance.

• Our vision of responsible investment contributes positively to the risk-return profile of SNPS' investments. In doing so, we take into account the ESG preferences of our participants.

Our responsible investment policy is guided by laws and regulations, guidelines, codes and covenants.

The United Nations

The United Nations (UN) has established a set of guidelines and principles that act as a benchmark on sustainable business. In our policies, we adhere to the following UN guidelines and principles:

• Global Compact (UNGC): This consists of 10 criteria relating to human and employment rights, the environment and anti-corruption. These conditions mean a great deal to us because we want only to invest in companies that do not violate them.

• Guiding Principles on Business and Human Rights (UNGP): These principles set out a framework for companies to adhere to human rights and are divided into, ‘protect’, ‘respect’ and ‘remedy’.

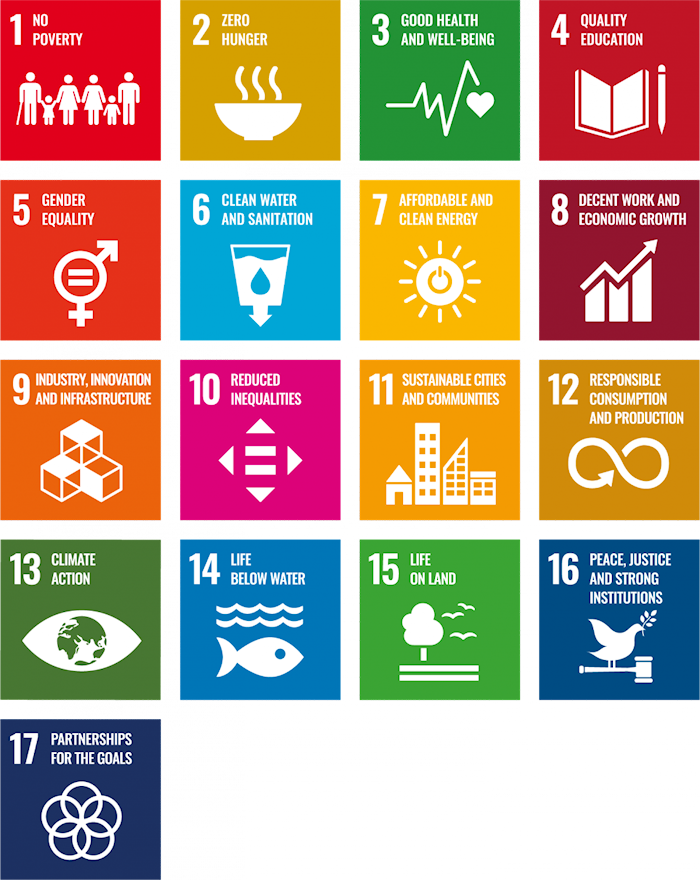

• Sustainable Development Goals (SDGs): We prioritize the UN's Sustainable Development Goals - SDGs - to help enable a sustainable world.

OECD guidelines

OECD is the acronym for the Organisation for Economic Co-operation and Development. The OECD guidelines provide businesses with concrete points of reference for dealing with supply chain responsibility, human rights, child labour, the environment and corruption. Specifically for institutional investors, such as our pension fund, the OECD directive applies: ‘Responsible business conduct for institutional investors’. It is expected of us to use the influence we have on companies that we invest in to prevent or reduce negative impact. We ask our fiduciary managers, ESG service providers and/or asset managers, and the companies in which they invest to act in accordance with or strive to adhere to the above guidelines.

Covenant on International Socially Responsible Investment for Pension Funds (IMVB covenant):

In 2018, we signed the International Socially Responsible Investment for Pension Funds (IMVB) covenant. This is a cooperative of pension funds, civil society organisations, trade unions and the government, which aims to promote Socially Responsible Investment and prescribes best practices, among other things.

We engage in conversations with companies

We firmly believe that active shareholder engagement is the best tool to drive positive change, hold companies accountable and encourage them to focus more on sustainability. Because by excluding and selling a company, you essentially lose your influence over a company and its operations.

For instance, we hold companies accountable for their policies and the activities if, in our view, they do not sufficiently consider the environment and society, also known as reactive engagement ('do not harm').

We also encourage companies to make improvements on specific topics (proactive engagement, ‘do good’). Where appropriate, we seek an open dialogue in collaboration with other institutional investors.

Engaging in dialogue with companies has been outsourced to EOS, an organisation specialising in engagement, which does this on behalf of several institutional investors. These conversations are guided by EOS' engagement policy.

We periodically add our own insights to the policy. This entails regularly reviewing whether EOS' engagement policy is still in line with our objectives.

Read the engagement results.

This is how we exercise our right to vote

A portion of the pension assets are invested in equities. One of the most important rights of a shareholder is the right to vote. Through voting rights a shareholder can help determine which decisions are made during shareholder meetings. When casting our vote, we look carefully at whether companies take the environment and society into account. We also consider it's important that there is sufficient diversity on a board and that the remuneration policy of a company's senior management is transparent and partly linked to sustainable objectives.

We cast our votes through EOS and adhere to the voting policy of EOS. We regularly review whether EOS' voting policy is adequately aligned with our objectives.

Read the engagement results.

We believe that by being an active shareholder, engaging in conversations and using our voting rights, is the best approach to bring about sustainable change. As an ‘ultimum remedium’, we exclude companies that violate the directives of the UN and OECD and fail to make progress on sustainable business practices. The board of the pension fund decides on any consequential action for each case. The assessment looks at the (potential) negative impact of the decision on society and the environment, as well as the impact on risk and return of the fund.

When we talk about exclusions, we distinguish two types of exclusions: legal exclusions and conduct-based exclusions. For investing in country bonds, we have an inclusion policy.

Legal exclusions

We exclude companies that act in breach of the law or that violate treaties or conventions that the Netherlands has ratified. For this reason, we don't invest in companies active in cluster munitions, land mines or chemical and biological weapons. As far as nuclear weapons are concerned, exclusions take place insofar as they involve activities of companies in violation of the non-proliferation treaty. In cases of exclusion, we also do not invest in loans issued by the company in question either.

Conduct-based exclusions

We invest your pension money in a wide range of companies. These companies are periodically screened for controversies. Controversies involve breaching international standards such as the UN Global Compact criteria. Through engagement, we enter dialogue - where possible - with companies whose conduct requires redirection. On top of this engagement, we exercise our voting rights at shareholders' meetings. At the point when companies make insufficient progress, they can be excluded as an ‘ultimum remedium’. We regularly monitor those companies that have been excluded to see whether sanctions can be lifted.

The pension fund invests pension contributions through mutual funds and a mandate (an investment portfolio with its own investment arrangements). In the case of the mandate, the pension fund has full control over the investee companies. For the investment funds, the exclusion policy of the respective fund applies. As part of selecting investment funds, the pension fund pays close attention to the ESG policy of the manager to ensure that it adequately reflects the pension fund's ESG views.

In 2015, the United Nations member states agreed to put society and the planet on a sustainable course by 2030. In the process, 17 Sustainable Development Goals were presented, often referred to by the acronym SDGs. Our investment policy aims to make a positive contribution to these goals.

In a survey among our participants, we asked which SDGs should receive the most attention. Four sustainable development goals emerged from the survey, matching our Shell identity: Gender Equality, Affordable & Sustainable Energy, Sustainable Cities and Communities, and Climate Action.

|

Gender Equality |

|

Affordable and Sustainable Energy |

|

Sustainable Cities and Communities |

|

Climate Action Urgent action is needed to combat climate change and its impact. Global warming is already affecting our daily live and the income of millions of people. This will only get worse in the future. |

Our vision

Climate change is an important topic on our agenda. Our vision is to help reduce the negative impact on climate in the future through our investments.

Our goal is to offer our participants a secure pension in a world worth living in. Not just now, but also in the distant future. Global warming affects every single one of us. It is therefore vital that everyone does their bit to mitigate the negative effects of warming. As a pension fund, we have an important fiduciary and social responsibility.

As a pension fund, we subscribe to a number of international conventions, guidelines, codes and covenants on socially responsible investing. Our policies also acknowledge the ESG preferences of our participants and our own fiduciary social responsibility. Policy formulation should not be just words but should also translate into action. In the 7 points below, you can read how, as a pension fund, we have integrated our ESG policy into the investment policy:

1. We engage in dialogue with companies (engagement) to bring about positive change (do good), but also when we believe companies are not adequately considering the environment and society (do no harm).

2. We exercise our voting rights at shareholder meetings.

3. We do not invest in companies (or bonds of companies) that are in some way involved in the production of cluster munitions, landmines, chemical and biological weapons.

4. We do not invest in companies (or bonds of companies) linked to serious controversies.

5. We aim to reduce CO2 intensity and improve companies' ESG governance scores.

6. We invest in Dutch mortgages and promote various sustainable initiatives through the asset manager.

7. We invest in infrastructure where we have included explicit emphasis towards renewable energy.