Sustainability information SSPF

This information serves to fulfil the disclosure requirements of Stichting Shell Pensioenfonds (SSPF) under Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector (Sustainable Finance Disclosures Regulation; SFDR) and the Commission Delegated Regulation (EU) 2022/1288 (SFDR Regulatory Technical Standard (RTS)).

This information serves to fulfil the disclosure requirements of Stichting Shell Pensioenfonds (SSPF).

No sustainable investment objective

This financial product promotes environmental and social (E&S) characteristics but does not have sustainable investment as its objective. Furthermore, this product does not intend to make any sustainable investments within the meaning of Article 2(17) of Regulation (EU) 2019/2088 (SFDR).

Environmental or social characteristics of the financial product

This financial product invests in multiple asset classes. The E&S characteristics promoted by this product may vary between asset classes and within the same asset class.

This product promotes the following E&S characteristics:

I. Lower carbon intensity

II. Improved governance

III. Exclusions (business activity)

IV. ESG inclusion criteria and

V. ESG reporting requirements.

Various sustainability indicators are used to measure the attainment of these E&S characteristics. These are periodically monitored through a process that is specific to each indicator.

Investment strategy

The strategy to attain each characteristic differs per indicator. This includes the use of custom ESG benchmarks and tracking-error constraints; the implementation of a business activity exclusion list; side-letter provisions in relation to externally managed funds*, sovereign inclusion list and custom ESG benchmarks that do not include issuers that fail to meet set criteria; assessment of externally managed funds on the basis of a framework on their level of ESG incorporation, pre-investment due diligence checks; and ongoing monitoring.

SSPF assesses investee companies’ governance practices by (a) identifying companies’ involvement in severe controversial business conduct on the basis of the UN Global Compact principles and OECD Guidelines for Multinational Enterprises, along with their responsiveness on any engagement efforts in this respect, (b) considering principal adverse sustainability impacts, (c) incorporating a governance rating, (d) assessing the level of ESG incorporation of (prospective) externally managed funds, and (e) applying Shell Group Principles.

*These disclosures make a distinction between the fiduciary manager, and other managers, collectively referenced by ‘external managers’ or ‘externally managed funds’. Because of the nature of the relationship between SSPF and its fiduciary manager, the expectations set in relation to monitoring the assets managed by the fiduciary manager differ from those related to external managers.

Proportion of investments

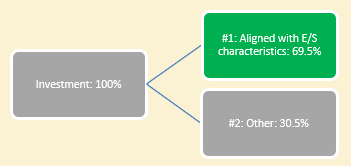

The average asset allocation of this financial product over a representative period of time prior to when these disclosures were made to assets that were aligned with one or more of the E or S characteristics was 69.5% of total assets, measured by market value.

Methodologies

There are various methodologies used to measure how the E&S characteristics promoted by this financial product are met. These include the comparison of the exposure of the portfolios in scope with the exposure of standard benchmarks; verification of no portfolio exposure to excluded issuers; verification that relevant side-letter provisions or similar management commitments have been implemented; assessment of the outcomes of pre-investment due diligence; and ongoing monitoring.

Data sources and processing

There are various sources used to measure and monitor the attainment of the E&S characteristics of this financial product. These include metrics, ratings and assessments provided by external data vendors and other third-party service providers; desk research; the outcomes of pre-investment due diligence and associated documentation; public data sources; external manager outreach; and the GRESB reporting tool.

Limitations to methodologies and data

The data selected for the E&S characteristics of this financial product are considered of sufficient quality to guide the implementation and attainment of the characteristics.

Due diligence

The due diligence process most relevant to the disclosures at hand relates to the monitoring of the E&S characteristics. The controls related to this process include the periodic review of the E&S characteristics by the fiduciary manager; review and distribution of the business activity exclusion list and its incorporation in pre-trade compliance tools; and the review of the investable universe criteria for sovereign debt instruments along with the communication of any changes to the criteria.

Engagement policies

SSPF defines engagement as SSPF using its influence to achieve sustainable improvements in relation to environmental and social policy and governance. SSPF seeks dialogue with company management via its ESG service provider, both proactively and reactively. On the one hand through proactive engagement, encouraging companies to make improvements to specific themes (‘do good’). On the other hand through reactive engagement (‘do no harm’) including violation of the UN Global Compact Principles.

Designated reference benchmark

This product uses reference benchmarks for the attainment, or the monitoring of the attainment, of some of the E&S characteristics promoted by this product. This concerns the characteristics ‘lower carbon intensity’ and ‘improved governance’ in relation to equity and corporate credit portfolios, and ‘ESG inclusion criteria’ with respect to sovereign debt.

Other forms of ESG incorporation

The description included in these regulatory disclosures only covers binding characteristics in the meaning of the SFDR; other forms of ESG incorporation, which take place on a discretionary basis, including but not limited to the ongoing integration of sustainability risks and opportunities in their investment decision-making processes, the periodic sustainability risk assessment and ongoing adverse impact due diligence, are not covered through these disclosures.

This financial product promotes environmental and social (E&S) characteristics but does not have as its objective sustainable investment.

Furthermore, this product does not intend to make any sustainable investments within the meaning of Article 2(17) of SFDR. Thereby, the investments underlying this financial product also do not take into account the EU criteria for sustainable economic activities, including the 'do no significant harm' principle.

This financial product invests in multiple asset classes. The E&S characteristics promoted by this product may vary between asset classes and within the same asset class, as further specified in the section 'What is the asset allocation planned for this financial product?’.

The following table specifies the E&S characteristics promoted by this product.

Table 2: E&S characteristics promoted by the product*

| Characteristic | Description |

| Lower carbon intensity | Parts of this product aim to achieve lower carbon intensity (scope 1 & scope 2 GHG emissions** over revenues in USD, expressed as tonnes of CO2 eq / USD mln revenue) than a standard (non-ESG) parent benchmark. Reference benchmarks are designated for the purpose of attaining the characteristic. |

| Improved governance | Parts of this product aim to achieve higher corporate governance rating than a standard (non-ESG) parent benchmark. Reference benchmarks are designated for the purpose of attaining the characteristic. |

| Exclusions based on business activities | This product does not invest in entities involved with cluster munitions, anti-personnel mines, biological and chemical weapons, and nuclear weapons in violation of the nuclear Non-Proliferation Treaty. |

| ESG inclusion criteria | Parts of this product apply minimum inclusion criteria. This concerns any of the following: • Minimum World Bank Governance score to be met by (quasi-)sovereign issuers in order for them to be included in the investable universe; a reference benchmark is designated for the purpose of attaining the characteristic, • No exposure to countries subject to a UN arms embargo; a reference benchmark is designated for the purpose of attaining the characteristic, and • Sufficient level of ESG incorporation related to externally managed funds assessed on the basis of criteria established in a framework managed by the fiduciary manager. |

| ESG reporting requirements | Parts of this product promote the fulfilment of an ESG reporting requirement in relation to external managers or externally managed funds. This concerns reporting on the basis of the UN Principles of Responsible Investment (PRI) reporting framework or the Global Real Estate Sustainability Benchmark (GRESB). |

* Detailed description as to the portion of the product to which each characteristic applies can be found in the section of this website titled ‘Proportion of investments’. Where a reference benchmark is used for the purpose of attaining a characteristic, a detailed description of how this is being done is provided in the section of this website titled ‘Designated reference benchmark’.

** Scope 1 & scope 2 GHG emissions: Scope 1 emissions are direct greenhouse gas (GHG) emissions from sources owned or controlled by the company. Scope 2 emissions are indirect GHG emissions derived from the generation of electricity, steam, heating and cooling purchased by the company for its own consumption. (Source: CDP).

The following table specifies the sustainability indicators used to measure the attainment of the E&S characteristics promoted by this product.

Table 3: sustainability indicator overview

| Characteristic | Description |

| Lower carbon intensity | Portfolio carbon intensity, expressed as tonnes CO2 eq / USD mln revenue (weighted average) |

| Improved governance | Portfolio governance rating (weighted average) |

| Exclusions based on business activities | • No portfolio exposure to entities involved with cluster munitions, anti-personnel mines, biological and chemical weapons, and entities involved with nuclear weapons in violation of the nuclear Non-Proliferation Treaty • Commitment by managers of new externally managed funds (selected on or after 1 January 2022) to either (a) prohibit investment in issuers (where applicable) or investment activities featured on the exclusion list, or (b) report such exposures, where the expectation is 0% exposure |

| ESG inclusion criteria | • No portfolio exposure to (quasi-)sovereign issuers*** not meeting the minimum set World Bank Governance score (applicable to sovereign debt only) • No portfolio exposure to (quasi-)sovereign issuers subject to a UN arms embargo (applicable to sovereign debt only) • Assessment outcome related to new externally managed funds (selected on or after 1 January 2022) regarding the extent to which they sufficiently incorporate ESG, assessed on the basis of criteria established in a framework managed by the fiduciary manager; a score of 3 out of 5 is considered ‘sufficient’ for the purpose of this assessment |

| ESG reporting requirements | • Portfolio exposure to externally managed funds whose managers report to PRI (applicable to all externally managed asset classes other than real estate) • Portfolio exposure to externally managed funds that report to GRESB (applicable to private real estate only) |

***(Quasi-)sovereign issuers: In the context of this characteristic, these are understood to be issuers 100% owned by a government or a government-related entity. The product thus does not have exposure to the debt issued by sovereign or quasi-sovereign issuers in relation to which the country of risk associated with that issuer fails to meet the minimum World Bank governance score and/or is subject to a UN arms embargo.

Investment strategy used to meet the environmental or social characteristics promoted by the financial product.

The following section describes the investment strategy used to meet the environmental or social characteristics promoted by the financial product, along with its binding elements (expectations in table 4 below). The fiduciary manager has set internal expectations and reports to SSPF if E&S characteristics are met or not.

Table 4: investment strategy used to meet the E&S characteristics and its binding elements

| Characteristic | Investment strategy description |

| Lower carbon intensity |

Expectation |

| Strategy Portfolio carbon intensity tilt is implemented through the use of custom ESG benchmarks and tracking error constraints. |

|

| Improved governance |

Expectation |

| Strategy Portfolio carbon intensity tilt is implemented through the use of custom ESG benchmarks and tracking error constraints. |

|

| Exclusions (business activity) | Exposure to non-compliant issuers - Expectation The product shall not have exposure to entities involved with cluster munitions, anti-personnel mines, biological and chemical weapons, and entities involved with nuclear weapons in a way that violates the nuclear Non-Proliferation Treaty. |

| Exposure to non-compliant issuers - Strategy Bi-annually, the fiduciary manager reviews an exclusion list containing the issuers excluded on the basis of their involvement with the specified business activities. The updated exclusion list is communicated by the fiduciary manager to relevant stakeholders. |

|

|

Exclusions (business activities)

|

External managers business activity exclusion requirements - Expectation Newly selected externally managed funds (selected on or after 1 January 2022) either (a) prohibit investment in issuers featured on the applicable exclusion list because of their involvement with cluster munitions, anti-personnel mines, biological and chemical weapons, and/or nuclear weapons in a way that violates the nuclear Non-Proliferation Treaty, and/or prohibit investment in these economic activities, or (b) have a reporting requirement relating to such exposures, where the expectation is 0% exposure. |

| External managers business activity exclusion requirements - Strategy The above requirements are part of pre-investment due diligence and, by preference, are embedded in each fund’s side-letter. An exemption can be granted to funds for which it is very unlikely that they would have any exposure to the excluded business activities, for example, on the basis of the investment instrument types included or to be included in a fund. |

|

| ESG inclusion criteria | World Bank governance score/UN arms embargo - Expectation The product shall not have exposure to debt issued by sovereign or quasi-sovereign issuers in relation to which the country of risk associated with the issuer fails to meet the minimum World Bank governance score and/or is subject to a UN arms embargo. |

| World Bank governance score/UN arms embargo - Strategy On a monthly basis the fiduciary manager identifies the issuers not meeting the World Bank Governance score and those subject to the UN arms embargo. The fiduciary manager communicates a list of these issuers to relevant stakeholders. A custom ESG benchmark constructed by JP Morgan that does not include issuers that fail to meet the inclusion criteria is used to attain the characteristic. |

|

| ESG inclusion criteria | Sufficient level of ESG incorporation - Expectation Majority of newly selected externally managed funds (selected on or after 1 January 2022) sufficiently incorporate ESG, as assessed on the basis of criteria established in a framework managed by the fiduciary manager where a score of at least 3 out of 5 denotes ‘sufficient level of ESG incorporation’. |

| Sufficient level of ESG incorporation - Strategy As part of selection process, externally managed funds are expected to showcase a sufficient level of ESG incorporation. Expectations around what constitutes a sufficient level of ESG incorporation are embedded in a framework managed by the fiduciary manager. These consider ESG policy, governance, the incorporation of ESG into investment and risk management processes, and reporting. |

|

| ESG reporting requirements | PRI - Expectation The managers of more than 60% of externally managed funds (excluding real estate) report to PRI, measured by market value. |

| PRI - Strategy As part of pre-investment due diligence related to the selection process and ongoing monitoring of existing funds, it is determined whether the manager reports or intends to report to PRI. |

|

| ESG reporting requirements | GRESB - Expectation More than 60% of externally managed real estate funds report to GRESB, measured by market value. |

| GRESB - Strategy As part of pre-investment due diligence related to the selection process and ongoing monitoring of existing funds, it is determined whether the manager reports or intends to report to GRESB (for the particular fund at hand). |

Policy to assess good governance practices of investee companies

The investee companies’ governance practices are assessed in the following ways:

• Assessment of controversial business conduct

A process is in place to identify issuers that are involved in severe controversial business conduct and that are not responsive to engagement efforts regarding this conduct, and to subsequently assess the desirability of their exclusion from the investment universe. This process includes a review of inter alia governance practices of investee companies on the basis of the UN Global Compact principles and the OECD Guidelines for Multinational Enterprises. Elements such as business ethics, fraud, corruption, and market abuse, but also social elements such as employee relations and freedom of association are taken into account.

• Consideration of principal adverse impact (PAI) indicators

This product’s investments are monitored on the basis of indicators aligned with the Commission Delegated Regulation (EU) 2022/1288 (SFDR Regulatory Technical Standard (RTS)) that relate to social and employee matters, as well as anti-corruption and anti-bribery. These indicators are periodically reviewed, which may lead to action to reduce the PAIs.

• Governance rating incorporation

Parts of the product* used to attain the characteristic ‘improved governance’ have a tilt to issuers with a higher governance rating. This means that portfolio exposure to issuers with lower governance ratings is reduced relative to a standard benchmark, including full exposure removal in individual cases. The governance rating process*** includes the assessment of elements such as sound management structures and tax compliance. Furthermore, the same parts of the product as those used to attain the characteristic ‘improved governance’ aim to maintain the social rating at least at par with a standard benchmark. The social-rating process includes an assessment of elements such as employee relations and staff remuneration.

* Parts of the product: Detailed description as to the portion of the product to which the characteristic ‘improved governance’ applies can be found in the section of this website titled ‘Proportion of investments’.

** Rating process: Conducted by an external data vendor, MSCI.

*** Social rating: Same as the governance rating, the social rating is also provided by an external data vendor, MSCI.

• Assessment of externally managed funds’ level of ESG incorporation

The assessment of ‘governance’ forms one of the four elements of the framework managed by the fiduciary manager to assess the level of ESG incorporation of externally managed funds for the purpose of the characteristic ‘ESG inclusion criteria’ described in Tables 2 and 3 in section 'Environmental or social characteristics of the financial product'. (Prospective) funds with less robust governance practices will score lower in the overall assessment and may be disqualified from investment.

• Shell Group Principles

Given its relationship to the Shell Group, SSPF applies Shell’s approach to tax and the Shell Responsible Tax Principles that guide decisions on tax matters, and is committed to compliance, being transparent about tax matters and being open to dialogue. Moreover, SSPF acts in line with the Shell General Business Principles and verifies where selected external managers have appropriate business principles in place.

What is the asset allocation planned for this financial product?

Given the E&S characteristics promoted by this product differ per asset class/sub-asset class/strategy, the product’s disclosures are done at two levels: overall (as required by SFDR) and per individual characteristic.

At the overall level and per individual characteristic, the field ‘#1 Aligned with E/S characteristics’ denotes the average asset allocation of the financial product over a representative period of time prior to when these disclosures were made that is aligned with one or more of the E or S characteristics. The category ‘#2 Other'* represents investments that do not contribute to any of the specific E or S characteristic promoted by this financial product, namely, developed markets sovereign debt, private loans, derivatives, and cash.

*More generally, according to para. 12 SFDR RTS Preamble, the category ‘#2 Other’ may contain, for example, hedging instruments, unscreened investments for diversification purposes, investments for which data are lacking or cash held as ancillary liquidity.

These disclosures are made for an existing product and the figures presented in Chart 1 and Table 5 below do not constitute a binding minimum commitment as to the proportion of the asset allocation of the product that would be at all times used to meet a specified E or S characteristic. Instead, they serve to showcase the proportion of the product that can be reasonably expected to be used to meet the specified E or S characteristic, barring larger changes in the overall (strategic) asset allocation of the product driven by investment considerations** . In the context of this product, the ‘#2 Other’ category - developed markets sovereign debt in particular, is expected to increase over time in line with the product’s de-risking journey. Therefore, no such minimum commitment is made.

** Investment considerations: Material changes in the overall (strategic) asset allocation of the product would trigger a review of the average asset allocation to the investments used to meet certain E or S characteristics.

The financial product consists of approximately two thirds direct and one third indirect investments, based on the average assets of the financial product over a representative period of time prior to when these disclosures were made.

Chart 1: average asset allocation of the product - overall

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

Same as at the overall level, at the level of individual characteristic the percentage average asset allocation relating to the ‘#1 Aligned’ assets reflects the proportion of the product used to attain a characteristic over a representative period of time prior to when these disclosures were made.

Table 5: average asset allocation of the product – per individual characteristic

| Characteristic | #1 Aligned | #2 Other | #2 Other– explanation |

| Lower carbon intensity | 24.7% | 75.3% | Includes equity and corporate credit portfolios which have not yet transitioned to the strategy; mortgages and private loans; sovereign debt; alternatives assets; derivatives; and cash. |

| Improved governance | 24.7% | 75.3% | Includes equity and corporate credit portfolios which have not yet transitioned to the strategy; mortgages and private loans; sovereign debt; alternatives assets; derivatives; and cash. |

| Exclusions based on business activities | 64.9% | 35.1% | Includes sovereign debt (other than quasi-sovereign issuers); private loans; derivatives and cash. |

| ESG inclusion criteria- World Bank governance score/ UN arms embargo | 4.4% | 95.6% | Includes developed markets sovereign debt as well as emerging markets – local currency sovereign debt, which are not formally out of scope of the criteria but are not directly impacted; all non-sovereign assets; derivatives; and cash. |

| ESG inclusion criteria- Sufficient level of ESG incorporation | 1.5% | 98.5% | Includes externally managed funds selected prior to 1 January 2022*** which are engaged on the expectations post-investment and where the alignment with the set expectations is monitored, but where the criteria did not apply pre-investment; and all assets managed by the fiduciary manager, including derivatives and cash. |

| ESG reporting requirements- PRI | 30.7% | 69.3% | Includes all assets managed by the fiduciary manager****, including derivatives and cash, and externally managed real estate. |

| ESG reporting requirements- GRESB | 3.3% | 96.7% | Includes all assets managed by the fiduciary manager, including derivatives and cash, and externally managed funds other than real estate. |

*** The approximate proportion of new externally managed funds selected on or after 1 January 2022 in the total product - indicated herewith at 1.5% - may grow over time but is dependent on the product’s de-risking journey where a greater proportion of assets may be allocated to liability matching assets managed by the fiduciary manager as opposed to externally managed funds.

**** The fiduciary manager is itself a PRI signatory. However, given the distinction made from a monitoring point of view between the fiduciary manager and external managers as outlined in footnote 1 on page 2, this monitoring process only concerns the latter.

Each E&S characteristic promoted by the product is monitored on the basis of set indicators through a process that is specific to each indicator, as laid out in the table below. The attainment of all E&S characteristics is periodically monitored by the fiduciary manager. The review of the E&S characteristics by the fiduciary manager is subject to an annual internal control. For the characteristics ‘Exclusions based on business activities’ (exposure to non-compliant issuers) and ‘ESG inclusion criteria’ (World Bank governance score/UN arms embargo), as further described in the table below, additional controls have been established by the fiduciary manager.

The fiduciary manager reports back to SSPF with regards to the attainment of all E&S characteristics. The report is discussed in the SSPF’s ESG forum, which constitutes of board members of SSPF, SPN and representatives of the fiduciary manager. The minutes of the ESG forum are distributed to the board of trustees of SSPF and discussed in the board meeting.

Table 6: description of a process to monitor individual E or S characteristics

| Characteristic | Monitoring process description |

| Lower carbon intensity | Fiduciary manager is responsible for ongoing implementation and monitoring of the characteristic. Moreover, the realisation of the desired ESG tilt is monitored on a bi-monthly basis by the fiduciary manager and reported to SSPF. |

| Improved governance | Fiduciary manager is responsible for ongoing implementation and monitoring of the characteristic. Moreover, the realisation of the desired ESG tilt is monitored on a bi-monthly basis by the fiduciary manager and reported to SSPF. |

| Exclusions based on business activities- Exposure to non-compliant issuers |

The excluded issuers are embedded into pre-trade compliance tools. Compliance with the exclusion list is reviewed bi-monthly by the fiduciary manager and reported to SSPF. On a semi-annual basis, the fiduciary manager verifies that the exclusion list has been reviewed, any changes have been communicated to stakeholders, and that appropriate pre-trade compliance blocks have been established (where relevant). |

| Exclusions based on business activities- External managers business activity exclusion requirements |

Fiduciary manager monitors and report to SSPF the proportion of newly selected externally managed funds (selected on or after 1 January 2022) that comply with the expectations set out in Table 4 (‘Investment strategy’).

|

| ESG inclusion criteria- World Bank governance score/UN arms embargo |

The World Bank Governance score and countries subject to the UN Arms embargo are monitored through a monthly review process by the fiduciary manager. In addition, also the portfolio and benchmark exposure to the issuers not meeting the inclusion criteria is monitored. Compliance with the inclusion criteria is reviewed bi-monthly by the fiduciary manager and reported to SSPF. On an annual basis, the fiduciary manager verifies that the investable universe criteria for sovereign debt instruments is reviewed and that any changes to the criteria are communicated to relevant stakeholders to allow for the monthly update of the investable universe and set-up of blocks in pre-trade compliance tools. |

| ESG inclusion criteria- Sufficient level of ESG incorporation |

Relevant investment teams monitor and report the proportion of newly selected externally managed funds (selected on or after 1 January 2022) that sufficiently incorporate ESG, as assessed on the basis of a framework administered by the fiduciary manager. Compliance with the expectations around ‘sufficient level of ESG incorporation’ is reviewed bi-monthly by the fiduciary manager and reported to SSPF. |

| ESG reporting requirements- PRI |

Relevant investment teams monitor the proportion of all funds in scope of the characteristic whose managers’ report to PRI. Compliance with the set expectations is reviewed bi-monthly by the fiduciary manager and reported to SSPF. |

| ESG reporting requirements- GRESB |

Relevant investment teams monitor the proportion of all funds in scope of the characteristic that report to GRESB. Compliance with the set expectations is reviewed bi-monthly by the fiduciary manager and reported to SSPF. |

The following table describes the methodologies to measure how the environmental or social characteristics promoted by the financial product are met.

Table 7: methodologies for measurement of environmental or social characteristics

| Characteristic | Methodologies to measure how the E or S characteristics are met |

| Lower carbon intensity |

The weighted average carbon intensity exposure of the portfolios in scope is compared with the exposure of a set of standard (non-ESG) benchmarks aggregated based on relative weights. |

| Improved governance |

The weighted average governance score exposure of the portfolios in scope is compared with the exposure of a set of standard (non-ESG) benchmarks aggregated based on relative weights. |

| Exclusions based on business activities- Exposure to non-compliant issuers |

It is verified that there is no portfolio exposure to the excluded issuers. |

| Exclusions based on business activities- External managers business activity exclusion requirements |

It is verified that relevant side-letter provisions (or similar manager commitments) have been implemented. |

| ESG inclusion criteria- World Bank governance score/UN arms embargo |

It is verified there is no portfolio exposure to the excluded issuers. |

| ESG inclusion criteria- Sufficient level of ESG incorporation |

As part of pre-investment due diligence, externally managed funds are assessed on their level of ESG incorporation on the basis of a framework. The outcome of that assessment informs the reported proportion of the newly selected funds that sufficiently incorporate ESG. |

| ESG reporting requirements- PRI |

As part of both pre-investment due diligence and ongoing monitoring, it is verified that the manager reports to PRI. |

| ESG reporting requirements- GRESB |

As part of both pre-investment due diligence and ongoing monitoring, it is verified that the manager reports or commits to report to GRESB for the specific fund at hand. |

The following table lists the data sources used to measure and monitor the attainment of the E&S characteristics promoted by the product.

In order to ensure data quality, either the data or the third-party providing the data are reviewed prior to their initial onboarding and on an ongoing basis after onboarding by the fiduciary manager.

The way data are processed differs per characteristic. Data are reported in a centralised reporting system administered by the Reporting team of the fiduciary manager. This centralised reporting system also serves as a storage for relevant underlying data sources and historic exposures.

With the exception of the metric ‘Carbon intensity’, where part of the data set may be estimated by the third-party providing the data, none of the metrics used should include estimated data. The proportion of the data that is estimated in relation to the metric ‘Carbon intensity’ fluctuates over time, but it makes up a minority of the data set.

Table 8: data sources used to measure and monitor the attainment of the E or S characteristics

| Characteristic | Data sources |

| Lower carbon intensity | MSCI ESG Carbon Metrics data set |

| Improved governance | MSCI ESG Ratings data set |

| Exclusions based on business activities- Exposure to non-compliant issuers |

• EOS Controversial Company Report (CCR) • Desk research |

| Exclusions based on business activities- External managers business activity exclusion requirements |

• Pre-investment due diligence / contractual provisions |

| ESG inclusion criteria- World Bank governance score/UN arms embargo |

• World Bank Governance score • List of countries subject to the UN Arms embargo |

| ESG inclusion criteria- Sufficient level of ESG incorporation |

Assessment outcome of the framework administered by the fiduciary manager on externally managed funds’ ‘sufficient level of ESG incorporation’, filled out on the basis of pre-investment due diligence |

| ESG reporting requirements- PRI |

• Pre-investment due diligence documentation • External manager outreach • PRI website |

| ESG reporting requirements- GRESB |

• Pre-investment due diligence documentation • External manager outreach • GRESB reporting tool |

The data selected for the E&S characteristics of this financial product are considered of sufficient quality to guide the implementation and attainment of the characteristics. Lower data coverage within parts of this financial product may be considered a limitation, but such limitations have been accounted for in how the methodologies are constructed, with coverage levels being sufficiently high to not affect the monitoring and attainment of the E&S characteristics promoted by this product.

There are many forms of due diligence carried out by the fiduciary manager in relation to the (prospective) investments of this financial product. The due diligence process most relevant to the disclosures at hand relates to the monitoring of the E&S characteristics, which is more closely described in the section ‘Monitoring of environmental or social characteristics’ above. The section ‘Monitoring of environmental or social characteristics’ also includes a description of existing controls related to the periodic review of the E&S characteristics; review and distribution of the business activity exclusion list and its incorporation in pre-trade compliance tools; and the review of the investable universe criteria for sovereign debt instruments along with the communication of any changes regarding the criteria.

Engagement is not part of the investment strategy used to meet the environmental or social characteristics promoted by the product. The investment strategy is described in Table 4 in section 'Investment strategy'.

This product uses reference benchmarks for the attainment, or the monitoring of the attainment, of some of the characteristics promoted by the product. This concerns the characteristics ‘lower carbon intensity’ and ‘improved governance’ in relation to equity and corporate credit portfolios, and ‘ESG inclusion criteria’ with respect to sovereign debt.

Lower carbon intensity and improved governance

To enable the attainment of the characteristics ‘lower carbon intensity’ and ‘improved governance’ in relation to equity and corporate credit portfolios, ESG-tilted benchmarks are supplied by external benchmark providers, separately for equity and corporate credit portfolios. The metrics used are the same as those used in the portfolio monitoring context described in Tables 2 and 3 in section 'Environmental or social characteristics of the financial product'. The data sources used for the benchmarks are the same as the data sources described in Table 8 in section 'Data sources and data processing' in relation to ‘Lower carbon intensity’ and ‘Improved governance’. All ESG data is provided by an external data provider that has been assessed on its qualities regarding ESG data and data provisioning.

The benchmarks are constructed through an (optimisation) process under which broad market benchmarks are tilted toward lower carbon intensity and higher governance rating. Namely, they are built with the objective to have 10% higher governance rating and 25% reduction in carbon intensity relative to a standard (non-ESG) benchmark. Their risk/return characteristics of the custom ESG benchmarks are similar to the standard (non-ESG) benchmarks, with limited deviations (tracking error and drifts) as well as turnover required to achieve the characteristics. Prior to implementation, the benchmarks have been back tested across the relevant regions or strategies, confirming the methodology works.

To ensure the investment strategy and the benchmark methodology are aligned, the relevant portfolios are managed against the custom ESG benchmarks, including in the context of performance and risk budget monitoring within the limits set in the IMA. This serves to ensure that the portfolios stay aligned with the custom benchmarks across the board. Depending on the exact strategy at hand, the portfolios may be rebalanced periodically, ensuring they stay close to the benchmark over time. The benchmarks are reset semi-annually for equities and annually for corporate credit, taking the most recent ESG data into account.

The attainment of the characteristics is then monitored on a bi-monthly basis relative to a set of standard (non-ESG) parent indices aggregated based on relative weights (separately for each asset class). Larger than expected deviations from the set expectations would be investigated and, where appropriate, corrected.

ESG inclusion criteria - sovereign debt

To enable the attainment of the characteristic ‘ESG inclusion criteria’ with respect to sovereign debt (emerging markets debt (EMD) hard currency), this product uses a custom benchmark from an external provider that does not include issuers that fail to meet the inclusion criteria. The metrics used and their corresponding data sources are the same as those described in Table 8 in section 'Data sources and data processing' in relation to ‘ESG inclusion criteria - World Bank governance score/UN arms embargo’. The relevant portfolios are managed against the custom ESG benchmark within the limits set in the IMA. This serves to ensure that the portfolios stay aligned with the custom benchmark across the board. The custom ESG benchmark is reset monthly. Compliance with the inclusion criteria is monitored by the fiduciary manager.